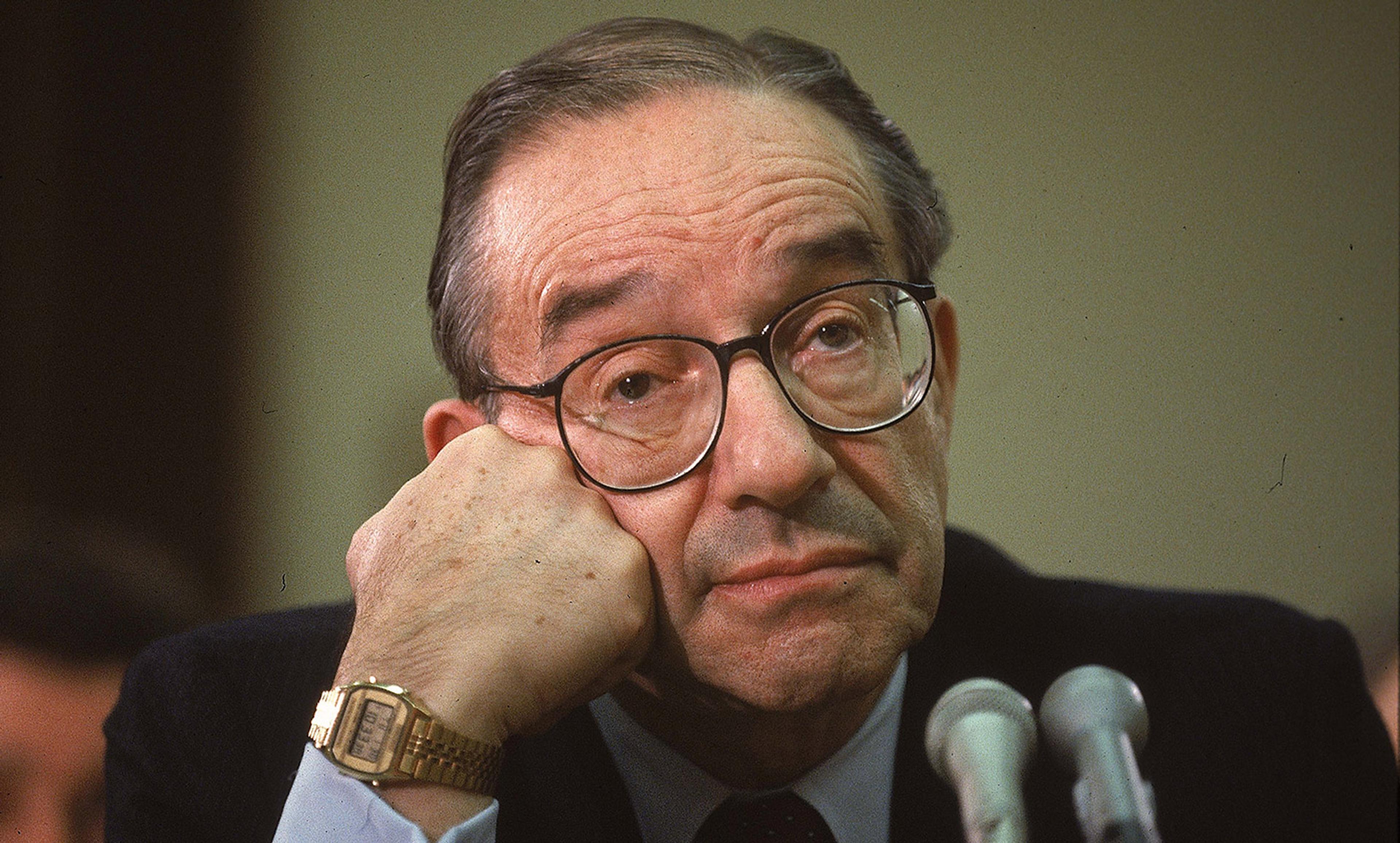

The man who knew too much. Alan Greenspan pictured in 1990. Photo by Terry Ashe/Life/Getty

Whether it was the physicist Niels Bohr or the baseball player Yogi Berra who said it – or, most likely, someone else – it is indeed hard to make predictions, especially about the future. This is certainly so regarding economic, social and political phenomena. If you don’t believe me, just ask the Nobel prizewinning economist Paul Krugman, who, writing in The New York Times on the night of Donald Trump’s election victory in November 2016, predicted an imminent global recession, from which global markets might ‘never’ recover. We’re still waiting. One is reminded of the quip by another Nobel prizewinning economist, Paul S Samuelson: ‘Wall Street indexes predicted nine of the past five recessions!’

And Krugman isn’t alone. In November 2006, Alan Greenspan, who earlier in the year had stepped down from his position at the US Federal Reserve, explained that ‘the worst is behind us’ with regard to the housing slump. He could not have been more wrong. Clearly, even smart people often get caught with egg on their faces when making predictions or even conjectures about what lies ahead. Humans are keen on foreknowledge, to which its place in numerous religions attests, and demand for diviners has long spilt over into the economic, social and political realms, which certain types of people are happy to supply. Although no modus operandi is failsafe, and no amount of training or experience can ensure success, as a historian I am convinced that the risks of making predictions can be reduced through the employment of a few simple historical tools, and by knowing a bit more about the past.

Before getting into history and the historian’s tool kit, however, let me point out that Krugman and Greenspan were following time-honoured traditions in making erroneous predictions. The economist Ravi Batra, for example, wrote popular books in 1989 and 1999 incorrectly predicting global depressions in 1990 and 2000 respectively, and in 1992 the economist Lester Thurow of MIT (sometimes referred to as ‘Less than Thurow’ by his detractors) wrote a bestseller called Head to Head, wherein he predicted that China ‘will not have a big impact on the world economy in the first half of the 21st century’.

And, lest one claim that I’m picking on economists, let me mention a few luminaries from other social sciences. In this regard, the political scientist Francis Fukuyama can be considered Exhibit A. In celebrated publications appearing between 1989 and 1992, Fukuyama explained to readers that history had reached its final stage of development with the triumph of liberal democracy and freemarket capitalism over authoritarianism and socialism, and the anticipated spread of both liberal democracy and freemarket capitalism around the globe. Oops.

Closely related to forecasting per se is what might be called the authoritative pronouncement with strong implications. In 1960, the sociologist Daniel Bell wrote a book arguing that the age of ideology had ended in the West, and in a book published that same year his friend, the political sociologist Seymour Martin Lipset, claimed that ‘the fundamental political problems of the industrial revolution have been solved’. And a few years earlier in The Affluent Society (1958), the Harvard economist John Kenneth Galbraith suggested that poverty in the US was no longer a major structural problem, but ‘more nearly an afterthought’.

Afterthought or not, let’s return to history and the historian’s tool kit, which for a variety of reasons in recent years have become a bit less déclassé in the minds of economists and other social scientists. This, after a long period in which not only history but also historically oriented work within the social sciences were often disparaged for being insufficiently theoretical, overly inductive, nonaxiomatic – indeed, rather ad hoc – and too concerned with ‘the anecdotal’, with ‘mere’ events, and with ‘isolated’ facts, rather than with the intentionally simplified generalisations known as ‘stylised facts’ that many social scientists prefer.

History was for antiquarians, ‘so yesterday’, a phrase popular with young people in recent years before the term itself became passé, and certainly no place for high-flyers in economics and the other social sciences. In economics, as a result, both economic history and (especially) the history of economic thought withered for a generation or two.

So what accounts for the recent change of course? For starters, there was the Great Recession – or ‘Lesser Depression’, as Krugman called it in 2011 – which seemed to a few influential economists such as Ben Bernanke, Carmen Reinhart, Ken Rogoff and Barry Eichengreen similar in many ways to other financial crises in the past. But there were other factors too, including the general retreat from globalisation, and the renascence of both nationalist and authoritarian movements around the world, which sounded the death knell for Fukuyama’s benign new world. Then, too, there was the astounding (if rather unlikely) international success of the French economist Thomas Piketty’s Capital in the Twenty-First Century (2013), which traces the trajectory of economic inequality over the past two centuries in the course of mounting a case against inequality today. As ‘history’ returned, so too has a degree of acceptance of historical approaches among social scientists, who sense, however vaguely, that though history might not repeat itself, it often rhymes, as Mark Twain (might have) put it.

Had economics not largely abandoned the history of economic thought, more practitioners would have recalled what Joseph Schumpeter had to say about history. In his History of Economic Analysis (1954), the great Austrian economist noted that what distinguished ‘scientific’ economists from others is ‘a command of techniques that we class under three heads: history, statistics, and “theory”.’ According to Schumpeter: ‘The three together make up what we shall call Economic Analysis … Of these fundamental fields, economic history – which issues into and includes present-day facts – is by far the most important.’

Not theory, not statistics, but history – what happened and why. While theory and statistics can help explain ‘why’ questions, first comes systematic study of the ‘who, what, where, when and how’ questions – purportedly quotidian questions to which many economists have, to their detriment, long given short shrift. Had they not spurned or, at best, passed lightly over history, more economists would have sensed in the run-up to the 2007-9 financial crisis that the situation, as Reinhart and Rogoff suggest, maybe wasn’t so different from earlier financial crises after all.

To be sure, Reinhart and Rogoff were not arguing that the 2007-9 financial crisis was exactly the same as earlier financial crises. Rather, they believe that the present is not free-floating but bounded, that the past matters, and that it can provide important lessons to those who study it in a systematic, or at least disciplined, manner. In other words, economists – not to mention sociologists and political scientists – would do well to supplement their stock-in-trade, analytical rigour, by thinking more historically. Here, they could do worse than to begin by familiarising themselves with Richard Neustadt and Ernest May’s classic Thinking in Time: The Uses of History for Decision Makers (1986), which would equip them with tools that would help to prevent forecasting bloopers and authoritative-seeming blunders due to egregiously incomplete information, misguided linear extrapolation, misleading historical analogies and spurious ‘stylised facts’.

Thinking historically, of course, entails both temporal and contextual dimensions and, in addition, often requires a significant amount of empirical work. Indeed, finding, assembling, analysing and drawing accurate conclusions from the bodies of evidence that historians call data is not for the weak of heart or, more to the point, for those short of time.

So, bottom line: economic forecasters would profit from thinking a bit more about history before gazing into their crystal balls, or at least before telling us what they see. Don’t get me wrong – I realise how hard making predictions is, especially about the future. So, one last point: if economic seers don’t want to think more historically or use empirical data more rigorously, they should at least hedge their bets. As a piece in The Wall Street Journal advised last year, put the chances of something happening at 40 per cent. If that something does in fact happen, one looks good. If it doesn’t, one can always say: ‘Hey, look, all I meant was that it was a strong possibility.’ Krugman might have dodged a bullet in 2016 had he followed that tack.